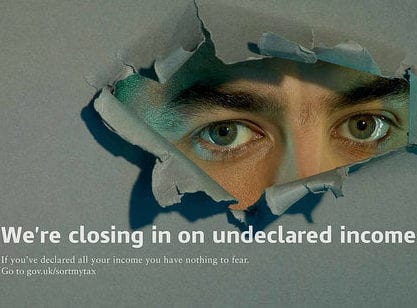

France’s Council of State has overturned an appeal by the Airport Nuisance Control Authority (ACNUSA), brought to challenge the overturning of fines it had imposed on three airlines, Darta, Brussels Airlines and Ixair. The airlines were fined €18,000, €23,000 and €7,000 in February 2013 for failing to respect authorised flying times at Nice-Côte d’Azur Airport.

An error in the drafting of an initial report had prevented ACNUSA from prosecuting the companies, but a second report had encouraged the supervisory authority to impose the fines against the three companies. Sitting in Paris, the Council of State confirmed the earlier decision of the Court of Appeal that the sanctions should be annulled.

The magistrates cited the general principle of law according to which “an administrative authority can not sanction the same person twice for the same acts”.

READ ALSO: Turkish Airlines flight causes panic in Nice

READ ALSO: Low-cost lowdown