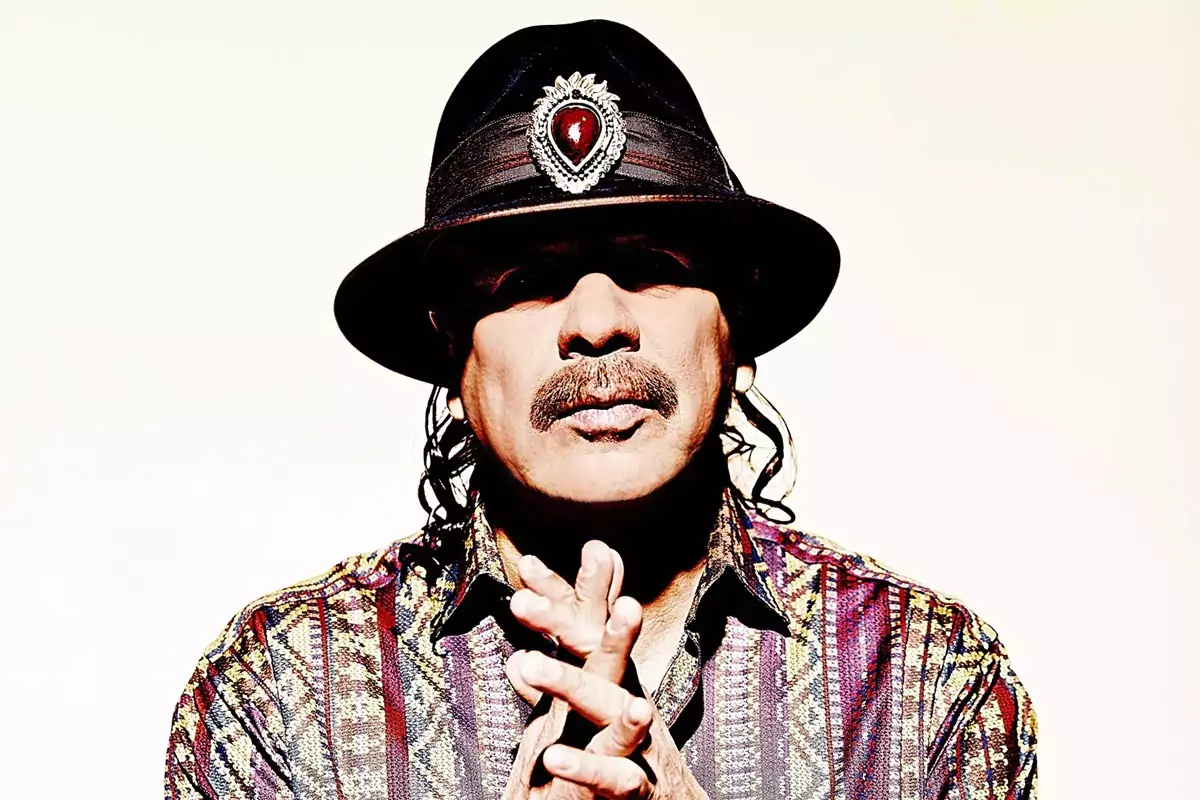

Carlos Santana, the legendary guitarist and eight-time Grammy Award winner, is set to electrify audiences in Europe this summer with a major tour that will include one very special stop-off in Monaco for the Monte-Carlo Summer Festival.

77-year-old Santana will be taking to the stage at the Monte-Carlo Summer Festival on 23rd July in a much-anticipated return to the Principality after a seven-year absence.

The Monaco gig, part of the annual Monte-Carlo Société des Bains de Mer-sponsored festival, promises to be a grand event showcasing Santana’s unparalleled talent. His setlist will feature high-energy, passion-filled hits from a repertoire spanning over five decades, including classics that have earned him a place in the Rock & Roll Hall of Fame and Rolling Stone’s list of the greatest guitarists of all time.

Ahead of the Principality show, Santana will play four concerts in France, starting with the Accor Arena in Paris on 23rd June, followed by a stint at Guitare en Scène in Saint-Julien-en-Genevois on 19th July. He will then head to the historic Arènes de Nîmes on 21st July, before concluding his French dates at Jazz à Marciac on 25th July.

The rock icon’s 2025 Oneness Tour kicks off in the United States on 1st April, with eight shows across the country before heading to Europe. The tour’s name, Oneness, is a nod to Santana’s 1979 solo album, reflecting his enduring philosophy of unity and harmony through music.

Santana’s return to Monaco is a homecoming of sorts. He last performed in the Principality in 2018 during his Divination Tour and has graced the stage at the Sporting Monte-Carlo many times over the years.

Santana’s European leg will wrap up on 11th August in Copenhagen, Denmark, marking the end of a journey proving his status as one of the most influential and enduring artists in music history.

While tickets for the Monaco concert have not yet gone on sale, updates will be available on the SBM website as well as Carlos Santana’s official page.

Monaco Life is produced by real multi-media journalists writing original content. See more in our free newsletter, follow our Podcasts on Spotify, and check us out on Threads, Facebook, Instagram, LinkedIn and Tik Tok.

Photo source: Carlos Santana, Facebook