According to Barclays Private Bank Chief Market Strategist Julien Lafargue, another difficult year looks to be on the cards in 2023, as the global economy and policymakers try to tame multi-decade inflation highs and adjust to a post-pandemic world.

In this financial outlook for 2023, Barclays Private Bank UK Chief Market Strategist Julien Lafargue gives Monaco Life readers his expert opinion on how a volatile 2023 could play out.

Growth may be tepid next year, but, at least in the United States, any recession should be short and shallow. That said, investment opportunities are popping up, keeping us constructive over the medium term.

The last 12 months have been full of surprises. A war in Ukraine, surging prices, and a sharp slowdown in China have created a broad-based, synchronised slowdown. Heightened geopolitical tensions, coupled with the aggressive tightening of financial conditions, have infringed on activity as business and consumer confidence take more of a knock. Only commodities have posted positive real returns in 2022 at the asset class level, and portfolios made up solely of stocks and bonds have had one of their worst calendar years in a century, according to Bloomberg.

Uncomfortably constructive

Looking ahead, we remain “uncomfortably constructive”. Indeed, we expect the next 12 months to be equally challenging. The prospect of slowing economic growth, if not recession, coupled with stubbornly elevated inflation, highlight the potential costs of central bankers not being able to strike the right balance between too much and not enough rate hikes. At the same time, with debt funding becoming increasingly expensive, governments won’t be able to pick up the stimulus baton as easily to rise to the rescue.

But with lower growth and supportive base effects, inflation should finally come down. The pace of this normalisation process is uncertain; however, it should be somewhat proportional to the deceleration in economic momentum, assuming that geopolitics don’t get in the way. We anticipate that both growth and inflation will moderate, rather than collapse, in 2023.

This backdrop is likely to lead to another particularly volatile year, making it easier for investors to get caught wrong-footed. With little sign that this period of heightened volatility is over, appropriate diversification and a focus on your long-term objectives remain essential.

UK, Europe, US, and China outlooks

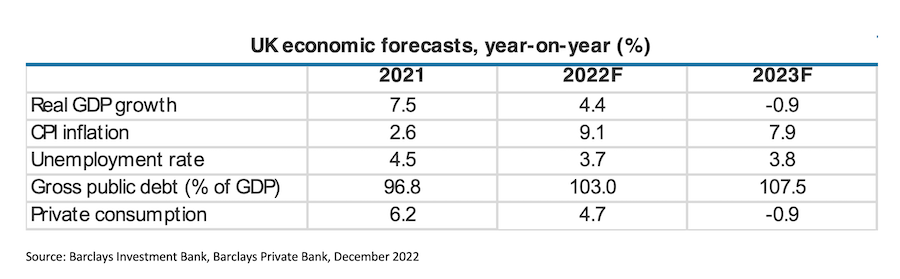

After an unforgettable year for UK politics and investors, as the economy dives into recession and the third prime minister of 2022 gets his feet under the desk, the next 12 months could be just as blustery. After being one of the fastest growing top-10 economies in 2022, the country now looks set to contract next year (see table below).

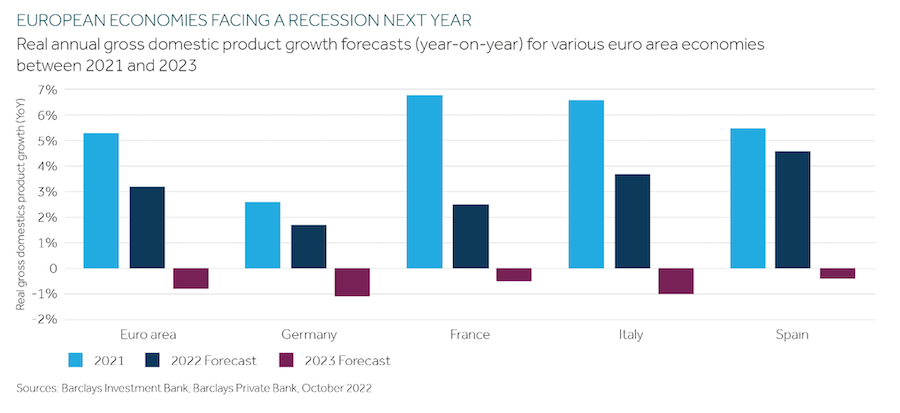

In Europe, it’s been an especially tough year for the eurozone economy. The prospect of energy shortages, a series of strikes leading to soaring wages, and battered consumer confidence means that a recession is more likely than not on the cards next year, with the bloc underperforming its developed world peers.

The region faces a number of economic challenges; however, price stability is the primary objective for policymakers. Inevitably, the cost of taming inflation will lead to a longer and deeper recession. We forecast that the eurozone will shrink by 0.8% in 2023, underperforming most advanced economies, led by Germany and Italy (see chart below).

In the US, the outlook is slightly more encouraging. The US economy is still expected to slow in 2023 before recovering as the year progresses. The pace of any slowdown will be dictated by the strength of the labour market, resilience of consumers, inflation trajectory, and the path of monetary policy.

A big question for economic prospects is how quickly China reduces the restrictions on its zero-Covid policy, helping to recharge economic growth in the country. China’s focus on containing the virus through containment measures, together with a property crisis and slowing demand for its exports, are at the heart of the subdued expansion prospects facing the world’s second-largest economy.

The Chinese economy grew by just 0.4% between April and June (Q2), the worst quarter (excluding the pandemic hit in Q1 of 2020) since data became available in 1992. The economy recovered in Q3, with gross domestic product (GDP) growth of 3.9%, which was still short of its official 5.5% target.

A new era for bonds

In last year’s Outlook 2022, we made the case that investors should be looking beyond investing in just traditional portfolios of stocks and bonds. Our main message now is that it may be time to revisit (and possibly rebalance) their bond exposure.

We continue to see attractive prospects for real assets and private markets, but, given the repricing in fixed income markets, we believe investors should look again at this part of their portfolio in particular. The risk-free rate — which had become the rate-free risk in the last decade — is finally back, and investors may now generate attractive income in public debt markets.

This repricing in rates hasn’t happened in a vacuum, and equity valuations too have sold off. Here, we expect markets to remain choppy until more clarity emerges on earnings in particular. While equities have been the only game in town for several years, this is no longer the case, and bonds are now a credible alternative (or at least complement) in portfolios. Over the medium to long term, we continue to see more upside in stocks than in bonds, but 2023 could be a more mixed year.

Energy transition

Finally, the rupture in energy markets last year has highlighted why countries need to secure access to reliable sources of energy. In this context, we are convinced that the energy transition to a low-carbon world will accelerate in 2023 and beyond, presenting investors with many opportunities.

Beware being too pessimistic

Next year will be another part of the difficult, but necessary, rebalancing act for central banks, governments, financial markets, and investors alike. But, amid all the pessimism, we see more opportunities today than at any point for some time.

The next 12 months may be another uncomfortable time to be invested. However, this is par for the course and part of the journey for long-term investors. After all, for those that can stomach the risk, the rewards can be worth it. Focusing on goals and holding a diversified portfolio are both ways to help shield investors from the unhelpful emotions that volatility can induce.

Photo of Barclays Private Bank UK Chief Market Strategist Julien Lafargue provided