Money makes the world go around. But what happens if the money dries up and the world stops turning? As we teeter on the edge of a global recession, many of us are stressed over our finances.

According to research conducted by the investment management company Blackrock, money is our number one source of stress. Most of us worry more about money than health, family and work. Money is a big deal.

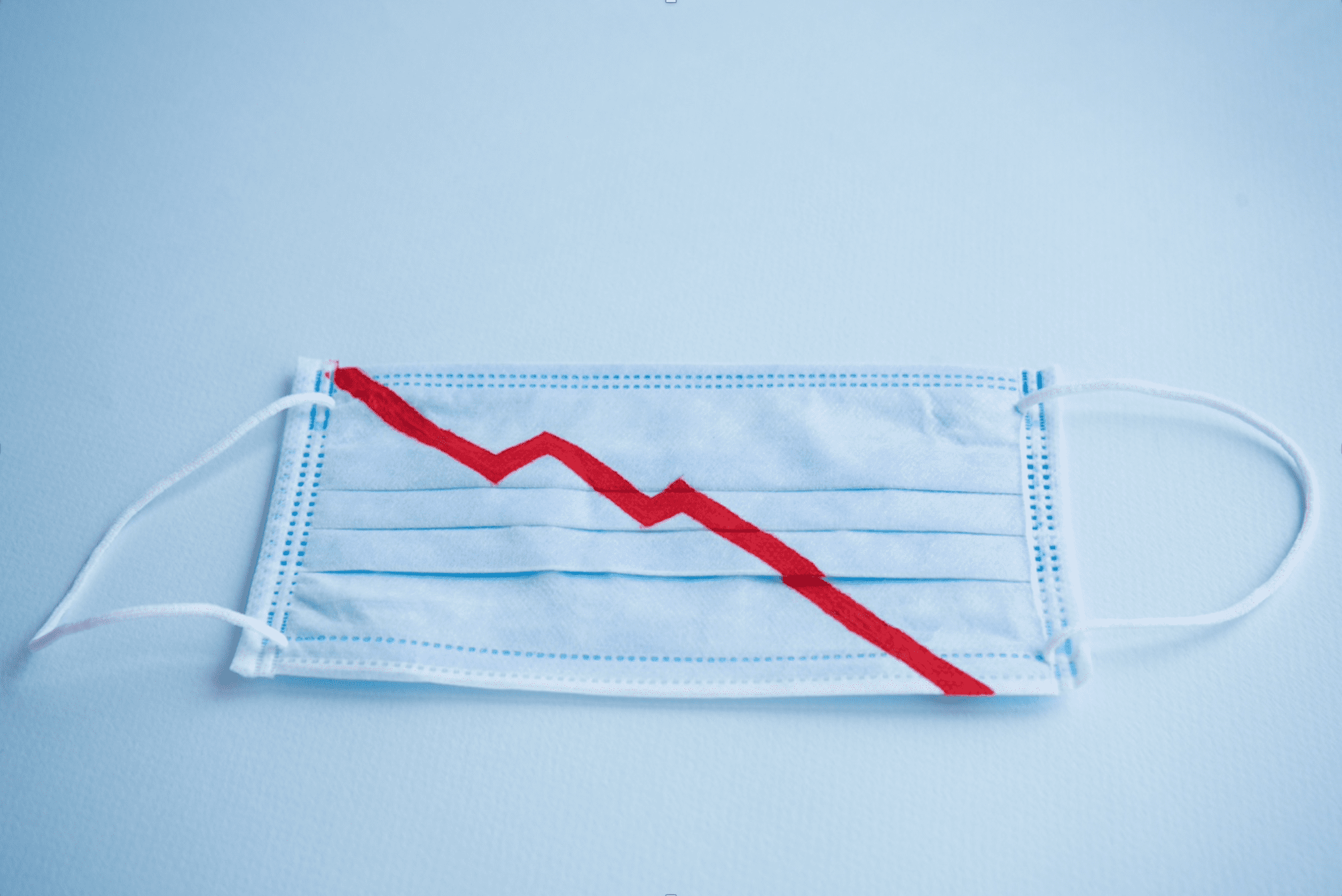

Add a pandemic to the mix and it’s not difficult to see why so many of us are not sleeping well at night. Not only are we worried about staying alive, we are also worried about having the resources to do so.

Why is money anxiety challenging?

The two emotions associated with money are fear and shame. We fear it might run out and we experience shame for having the feeling. It’s a double bind.

Money is a scarce resource and the fear that it might run out is primal. It ties in with our survival instinct. That is why the anxiety is heightened. It’s an existential fear.

To make matters worse, money is a taboo. We are less likely to share our money problems and more likely to talk about our sex lives.

Money beliefs and financial stress

How might money anxiety affect those of us living and working in Monaco? Financial anxiety has little to do with wealth. The size of our bank account does not inoculate us from financial stress. It has more to do with what we think and believe about money. It is those thoughts and beliefs which can leave us feeling trapped.

The psychologists Brad and Ted Klontz are pioneers in the field of financial wellbeing. They contend that we all have “money scripts”. These are our thoughts, attitudes and beliefs about money. They are largely unconscious and stem from our childhood.

In other words, many of our financial decisions are driven less by our rational beliefs and life circumstances and more by unconscious drives. So, if you think you made that decision to invest in a particular stock based on all the facts, think again. It was also emotionally driven.

I worked with a wealthy client in therapy some years ago. Let’s call him Fred. He grew up in a wealthy family and his father, who was largely absent from his life, was a high-profile entrepreneur. Fred observed that money and power were correlated, and his unconscious narrative was that “One can never have enough. Money is power”. His self-worth was tied to his net worth. After a very bad financial investment, Fred lost about a third of his wealth.

Fred came to see me after experiencing a major breakdown which partly led to the breakup of his family. The cruel irony is that Fred never needed to work again notwithstanding his financial loss. However, it was how he interpreted his situation which caused him the distress rather than the situation itself. Much of our work was in dissecting his early core beliefs about money which were keeping him feeling trapped. He didn’t recover his marriage but he did start to evaluate his life through a healthier lens.

Alternatively, Fred might have concluded that money is bad. His father was a workaholic and there wasn’t much family time. If he had concluded that “money is evil”, as many people do, he might have spent his life avoiding wealth accumulation. He might have self-sabotaged opportunities for promotion or unconsciously lived a more frugal existence so as to avoid money’s evil curse.

Our early experiences of money and what we learned about money is forever playing out in the background of our lives.

Money and relationships

Recently it has been hard for couples to avoid money issues. Most of us have been affected by the pandemic in one way or another. When couples argue about money, it is rarely about the money itself. It is what money represents. Money can represent security and safety to one person and fun and adventure to another. It is usually a clash over these philosophies that underpin a couple’s argument over money.

What makes money in relationships so emotionally charged is that opposites usually attract. Savers tend to marry spenders. I worked with a couple who had inherited some money a few years into their marriage. The wife saw the money as an opportunity to secure a college fund for the kids and pay off their debts. The husband viewed the money opportunity to buy a sports car and upgrade the house’s electronics. They both came into the therapy room adamant that their approach was the sensible one and looked to me for vindication.

Growing up, they had each had a very different relationship with money. The wife had seen her father lose his job and suffer depression as a result. The husband had grown up in an environment where his parents spent what they earned. They were each coming to the table with different money beliefs based on what money symbolised.

Maybe it takes a pandemic to work all this out. During the early stages of our romantic relationships, we look for shared meaning. We bask in the symbiosis of love. We tend not to discuss our plans for retirement or our philosophies and fears around money. My advice to newlyweds is never mind mastering the Kama Sutra positions, sort out your money positions first!

Conquering our money anxiety

High debt levels, fickle stock markets, losing a job (or even the prospect) and low savings rates cause financial anxiety. All of that is in the air these days. You are not alone. The key is to determine what’s real and what’s the baggage brought into the relationship. As I often say to my clients, “If it’s hysterical, it’s historical”.

If you are stressed about money as a result of the pandemic, I recommend you consider the extent to which your money beliefs are filtering your interpretation of the facts.

Stay with what’s real and current. We often get caught in catastrophising the future and we allow our fears to overcome us. A short-term action plan is often what is needed.

If you are in a relationship, you need to spend time looking calmly at the situation and reaching any decisions about money together.

It is worth remembering that for many of us, we will survive the financial impact of the pandemic. There might be a change in our financial circumstances (which will trigger those early money beliefs) but we will most likely emerge with a roof over our head and the capacity to work again. (I do not want to minimise in any way the reality for people who may have lost jobs or whose circumstances have dramatically changed).

Financial wellbeing

I believe that financial wellbeing should not be considered in isolation. When we are satisfied in our key relationships and careers and feel physically healthy and spiritually connected, we feel financially secure. We spend less time comparing ourselves to others. When we appreciate our financial wellbeing is only partly connected to our income level, it’s surprising how we suddenly feel more affluent and a lot more blessed.

Gavin Sharpe is a UK qualified psychotherapist, relationship/psychosexual therapist and executive coach. The thoughts and opinions expressed in this article are his own, and not necessarily those of Monaco Life. Gavin Sharpe can be reached at www.rivierawellbeing.com.

Gavin will be running a free zoom webinar on Financial Stress & Anxiety on Thursday 4th June at 11:30 (CET). Register here.

The currency of Covid: money stress