“Authenticity is invaluable; originality is non-existent.” While the very talented Jim Jarmusch may not be talking about art prints, this well observed statement rather beautifully captures a point often overlooked by art collectors.

[ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”2″ ihc_mb_template=”1″ ]

Significant value, both aesthetic and financial, is regularly missed by the mistaken beliefs that a) prints are just cheaper copies of real art, and b) prints have no investment benefit to art collections.

When acquired carefully they can be an excellent addition to a portfolio whether you are buying for purely decorative reasons or as part of a wider investment strategy. In this article I shall try to clarify an underappreciated part of the market, and to cut through the horribly confusing mess of technical terms and art jargon.

Unfairly written off as mass-produced and therefore lacking in value, printed works can give you the ability to own a broad selection from your favourite artists that may otherwise be impossible to acquire.

To buy Koons or Chagal for four figure sums represents fantastic value, and when bought sensibly these pieces tend to hold their value. They can also sell for very significant sums. Earlier this year I attended a Christies auction offering an exceptional Picasso aquatint print at a guide price £30,000 to £50,000, a Toulouse-Lautrec lithograph sold through Sotheby’s in 2015 for just shy of £11 million.

Prints are also excellent introductory purchases for new collectors, a chance to dip toes into the art market without much risk. However, for both new and experienced collectors alike there are a range of confusing terms and options that can deter purchase. Understanding these is vital for making a considered decision. Our clients have generally found a decent explanation of the lingo to be useful, where many art dealers love the confusion (often intentionally obfuscating to remain as “vital” as possible).

So, what to consider when assessing the value of a print?

Open vs. Limited editions

The first thing to consider is supply: How many are available? Market forces apply in art as you would expect – scarcity creates value. Open editions have no cap and are a way to sell at high volume and low value. Appreciation is unlikely however they can be a fun way to buy low-cost art to decorate your home. Limited editions are set to a certain number, though bear in mind that these limits can run to the thousands. To have a chance to at lease hold value you really want to be looking at sizes of 200 to 400. This should cover all size options of the same image. Note that:

- Sizes may vary within an edition; usually the larger options will have less availability than the smaller ones.

- Prices can rise within the edition; if an artist sells quickly no.1-30 of an edition of 100 they have the ability to change prices.

- The first in the edition is usually the most valuable, while an artist/dealer may choose to charge a small premium for no.1 (around 10%) this has the greatest potential for price rises.

Original print vs Reproductions

A print will be one of two things – a reproduction of another work (e.g. an oil painting/watercolour) or an original which only exists as a print. The latter carries greater value as it is the medium chosen by the artist and is often created by their own hand or, if not, under their strict instruction.

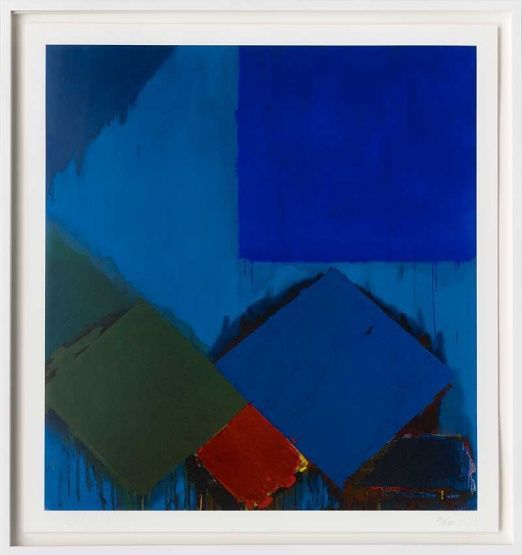

John Hoyland, for example, created a selection of exceptional original prints using a wide range of techniques that creates colours and textures that feel notably distinct from his paintings. We are fortunate enough to have access to some wonderful examples directly from the Hoyland Estate.

Signature and print run number

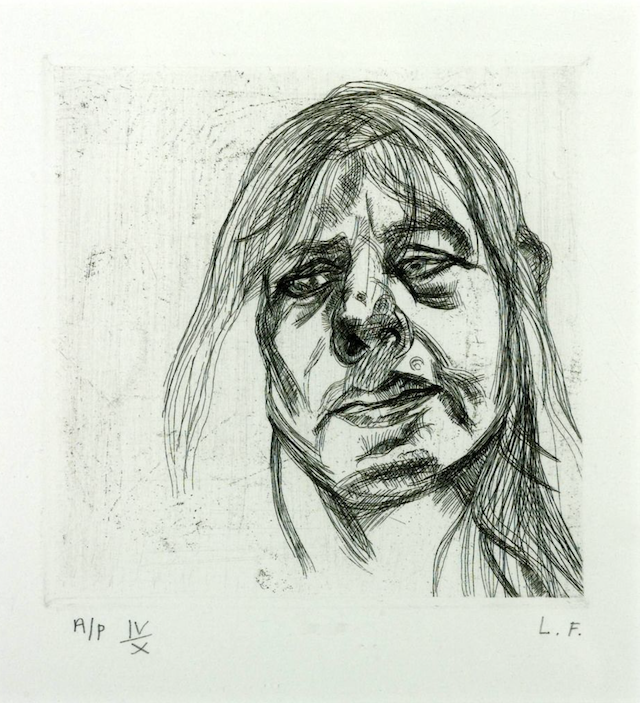

Limited editions will always be numbered, generally in pencil at the bottom of the print. This shows how many prints are in the run and in what order this one was printed. Generally speaking the larger the number the smaller the value.

Most artists will sign their prints, and some printers will too. Look for this as it has a large impact on price – signed prints are roughly three times more valuable than unsigned versions. The greater proof of authenticity, as is true throughout the art market, the greater the value.

P/Ps, A/Ps, H/Cs, BATs

Other than print run numbers you may run in to the above notations, which has understandably confused our clients. Does this mean these prints are somehow dodgy? Far from. Generally, these terms add significantly to the value of a work. Here’s why.

A/P = Artist’s Proof

These are versions unintended to be sold, and are meant to be kept by the artist for their own pleasure. They do often find their way to market and usually sell for higher prices given their rarity.

P/P = Printer’s Proof

Similar to Artist’s Proof, there may be one or two copies that the printer may have the right to retain based on an agreement with the artist.

H/C = Hors de Commerce

Translated from the French for Do not sell, they can be treated as per A/Ps, and are usually made for galleries or dealers to show. Older works from famous galleries, dealers or artists can be made significantly more valuable with and H/C and solid provenance.

B.A.T = Bon A Tirer

Ready for printing pieces are tests made by the printers for the artist’s approval prior to a final set up. They are very rare and can often give insight into the artist’s mind, especially if there are subtle changes made prior to the final edition.

Printing techniques

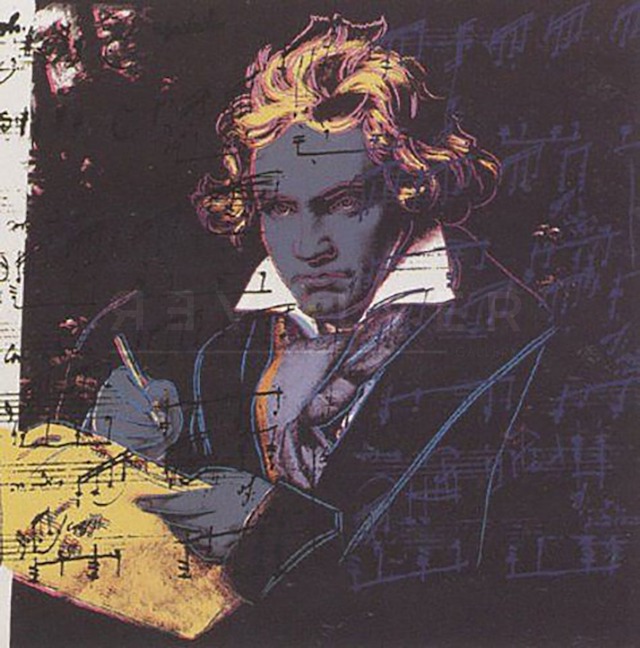

Printing techniques are broad, from lithography to woodcutting, aquatint to etching, and result in hugely distinct finishes. I could write several articles about each, so rather than go into lots of detail I would encourage you to find prints that you like and then note what technique was used. Over time you will naturally find personal preferences.

Some artists stuck with one technique and one printing studio, others changed throughout their career. Lucien Freud would produce vast numbers of black and white etchings in the days that followed his studio work, Jasper Johns created prints throughout his career where others fell in and out of love with it across their careers.

Whether you are a first-time collector who wants something beautiful for your home, or a collector looking to find value in a congested market, we would advise that you find an advisor you trust and take your time. The process of learning what you want to buy is a fascinating one and the best decisions are usually the slowest ones. Go to some shows, find artists you love who created editions, and continually ask yourself why you love what you love and, perhaps more importantly, why you hate what you hate.

ABOUT THE AUTHOR

Oliver Hawkins is a Director at Marshall Murray, an art advisory with years of experience in the curation of artwork for private collections, corporate collectors and design professionals. For further information he can be contacted via enquiries@marshallmurray.co.uk

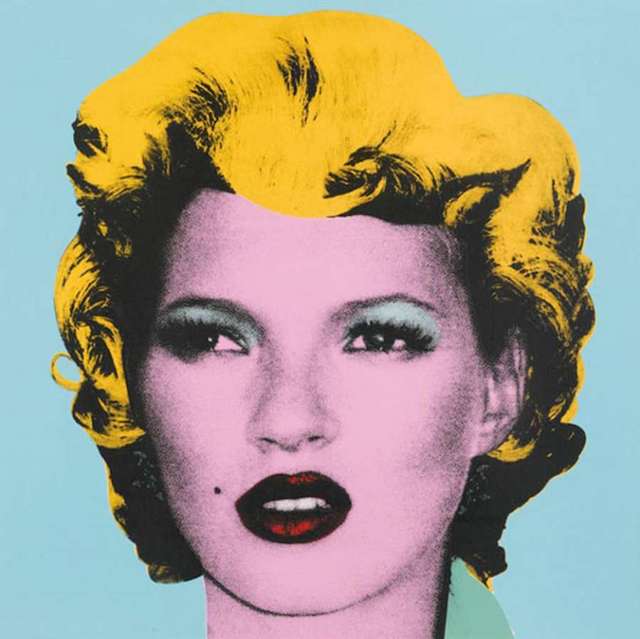

Top photo: Kate Moss, Banksy.

[/ihc-hide-content]