The UK’s sweeping tax reforms, effective April 2025, are pushing high-net-worth individuals to reconsider strategies. With no personal income tax, Monaco’s regime offers an attractive alternative for relocation.

The UK is set to undergo one of the most significant tax reforms in decades, with the Finance Bill, published on 7th November, introducing major changes effective from April 2025. A key highlight is the abolition of the non-domiciled (“non-dom”) status, which will be replaced by a “long-term UK resident” classification. Individuals who have been UK residents for 10 of the past 20 years will fall under this category, bringing them into the scope of worldwide taxation and potentially increasing their liabilities substantially.

The reforms also include the end of the remittance basis of taxation, which has allowed non-doms to pay UK tax only on domestic income and gains, plus foreign income brought into the UK. From 2025, all income and gains, regardless of location, will be taxed. Capital Gains Tax (CGT) rates will rise across the board, while changes to Inheritance Tax (IHT) rules will see overseas assets included in taxable estates, and spousal exemptions capped for non-resident spouses.

Trusts are also affected, with reforms tightening the definition of excluded property. From 2025, the settlor’s UK residency status at death will determine whether overseas assets in trusts remain exempt from IHT, reducing protections for international wealth.

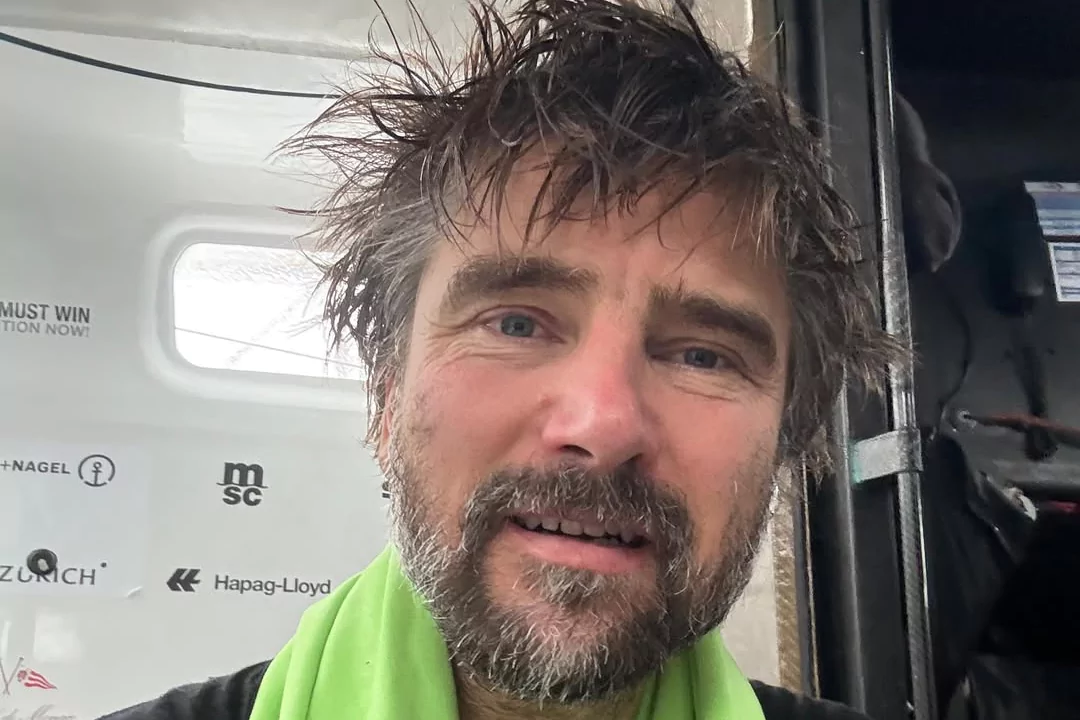

These changes mark a turning point for many high-net-worth individuals who may need to reassess their tax strategies. Monaco, known for its absence of personal income tax and favorable inheritance tax rules, is becoming an attractive option. Audrey Michelot, a tax expert at CMS Monaco, highlights the Principality’s appeal for those considering relocation in response to the UK’s sweeping reforms.

Monaco Life: Why is Monaco’s tax regime particularly appealing to UK residents?

Audrey Michelot: The defining characteristic of Monaco’s tax regime is its complete absence of personal taxation. For individuals residing in Monaco, there is no personal income tax, no wealth tax, no capital gains tax, no withholding tax, and no local tax on real estate property. This applies to both Monegasques and foreign nationals—except for French citizens due to specific agreements.

Unlike the UK, Monaco does not differentiate tax treatment based on the source of income. Whether the income is generated in Monaco or abroad, the same rules apply. Residents only need to consider if the country of the revenue’s source imposes withholding taxes or other obligations.

Are there any specific tax obligations or considerations for new residents in Monaco?

New residents in Monaco have minimal tax obligations. Monaco joined the Common Reporting Standard (CRS) in 2017, enabling automatic financial account reporting between banks and tax authorities in participating countries. This process requires no additional action from residents, apart from completing a form when opening a Monaco-based bank account.

Are there situations where Monaco residents might still face tax liabilities in the UK?

Yes, potential tax liabilities in the UK depend on an individual’s ongoing ties to the country. For example, the new UK rules establish a 10-year period during which inheritance tax may still apply to former UK residents classified as long-term residents (for 20 years or more) before their move. For those relocating in 2025, UK inheritance tax obligations could continue until 2035. Consulting a UK tax advisor is essential to ensure compliance and proper planning.

What about taxation for businesses in Monaco?

Monaco’s tax regime is notably attractive for businesses, with corporate income tax applying only to companies that carry out commercial or industrial activity and generate over 25% of their turnover outside Monaco or engage in specific activities such as licensing income from patents. The corporate tax rate for these businesses is set at 25%.

See also: Making a will in Monaco: what international residents need to consider

Monaco also offers a range of incentives designed to support businesses. New companies can benefit from tax credits during their initial years of operation, while deductions are available for directors’ remuneration, helping to reduce overall tax liabilities. Administrative offices of foreign companies can take advantage of a cost-plus tax regime, where only the services provided to the broader group are subject to taxation. Additionally, businesses involved in innovation can benefit from research and development tax credits.

These features make Monaco a compelling option for startups and established enterprises alike, particularly those seeking a tax-efficient base for their operations.

How does Monaco’s inheritance and gift tax regime compare to the UK?

The differences between Monaco and the UK are considerable. In the UK, inheritance tax is set at 40% for transfers exceeding £325,000. In Monaco, however, inheritance and gift taxes apply only to assets physically located within the principality, with no tax levied on foreign assets.

Monaco’s tax rates for inheritance and gifts are significantly lower than those in the UK and vary based on the relationship between the parties involved. Transfers between spouses and direct descendants, such as children and grandchildren, are entirely tax-free. Transfers to civil partners incur a modest 4% tax, while siblings face an 8% rate. Transfers to uncles, nephews, are taxed at 10% and other relatives are taxed at 13%, and for non-relatives or entities, the rate is capped at 16%.

Monaco’s civil law framework also contrasts with the UK’s common law system. While Monaco does not have domestic trust laws, it has adapted to the needs of its international residents by recognising foreign trusts under a 2022 legal reform. This change allows residents to benefit from the principality’s favourable tax rates rather than the flat 16% rate that previously applied to foreign trusts, providing a more flexible and efficient way to manage asset transfers.

Have you observed an increase in interest from UK residents since the announcement of the UK tax reforms?

Absolutely. We’ve seen a marked rise in inquiries, particularly from non-domiciled UK residents who anticipated these changes. Many have already started the relocation process, including obtaining visas and residence permits. By early 2025, we expect an influx of UK residents officially moving to Monaco.

What advice would you give to UK residents planning to relocate to Monaco?

Planning is critical, especially post-Brexit. UK citizens must apply for a long-stay visa (visa D), a process that takes at least three months. After obtaining the visa, they must apply for Monaco’s residence permit (carte de séjour), find accommodation, and open a bank account. Since opening a Monaco bank account involves rigorous compliance checks, this step alone can take one to two months.

Overall, the entire relocation process can take five months or longer, so starting early is crucial.

Beyond its tax benefits, why is Monaco an attractive place to live?

Monaco offers unparalleled stability—economically, politically, and legally. Monaco also boasts a high level of security, an excellent international education system, and a family-friendly environment. Residents enjoy world-class services comparable to those in the UK or the EU, making Monaco a premier destination for individuals and families alike.

Monaco Life is produced by real multi-media journalists writing original content. See more in our free newsletter, follow our Podcasts on Spotify, and check us out on Threads, Facebook, Instagram, LinkedIn and Tik Tok.