Monaco has received formal recognition from the Financial Action Task Force for its sweeping reforms to combat money laundering and terrorist financing, following submission of its first progress report since joining the FATF grey list in June 2024.

The Principality of Monaco has been officially praised by the Financial Action Task Force (FATF) for making marked improvements in its anti‑money laundering (AML) and counter‑terrorist financing (CFT) framework. The recognition came during the joint FATF–MONEYVAL plenary held in Strasbourg on 13th June, where Monaco’s first voluntary progress report was reviewed.

The FATF, which monitors jurisdictions under increased scrutiny, confirmed that Monaco had “largely addressed” all items scheduled for completion in this first reporting cycle. “The FATF welcomes [Monaco’s] commitment and will closely monitor their progress,” read the organisation’s official communiqué. It added that while the Principality remains under increased monitoring, FATF encourages members to take into account the advancements made by the jurisdiction, warning against blanket de‑risking practices that disrupt humanitarian aid or legitimate financial flows.

United national effort behind Monaco’s progress

In its response, the Princely Government welcomed the endorsement from FATF, crediting the result to “a large-scale mobilisation of all Monegasque services and authorities involved”. It stated that this collective momentum was coordinated through a high-level national committee responsible for overseeing the Principality’s AML, CFT, anti-proliferation and anti-corruption strategy.

The government also acknowledged the ongoing support of MONEYVAL and the FATF secretariat, saying it “salutes the quality of exchanges and the mobilisation of the FATF teams” throughout the review process.

Progress against the action plan

Monaco’s inclusion on the FATF grey list in June 2024 followed a 2022 mutual evaluation that highlighted a need for urgent reform. Since then, it has significantly increased technical compliance, with seven of FATF’s 40 recommendations now deemed fully compliant and 32 largely compliant. Just one recommendation remains partially compliant.

In the most recent assessment, FATF highlighted not only progress on items due this year, but also meaningful steps taken on future-dated commitments—an early indicator of Monaco’s determination to exit the grey list within its agreed timeline.

Future milestones and sustained reforms

In April, Monaco adopted its National Strategy and Action Plan for 2025–27, aiming to fulfil remaining FATF obligations. The roadmap focuses on expanding cross-border asset seizure capabilities, enhancing the role of the financial intelligence unit, reinforcing judicial infrastructure, and introducing deterrent penalties for non-compliance.

As the government put it, the Principality is “fully committed to continuing efforts to implement the action plan and exit the FATF grey list within the planned timeframe”.

Restoring international financial confidence

The FATF reiterated that its monitoring does not call for additional due diligence measures against grey-listed countries, nor does it advocate financial disengagement. Instead, it urges a risk-based, proportionate approach, underlining that Monaco’s continuing cooperation sets a positive example.

This latest development is seen as a significant step towards restoring Monaco’s standing in the global financial system and affirms its trajectory toward greater transparency and institutional resilience.

Monaco Life is produced by a team of real multi-media journalists writing original content. See more in our free newsletter, follow our Podcasts on Spotify, and check us out on Facebook, Instagram, LinkedIn and Tik Tok.

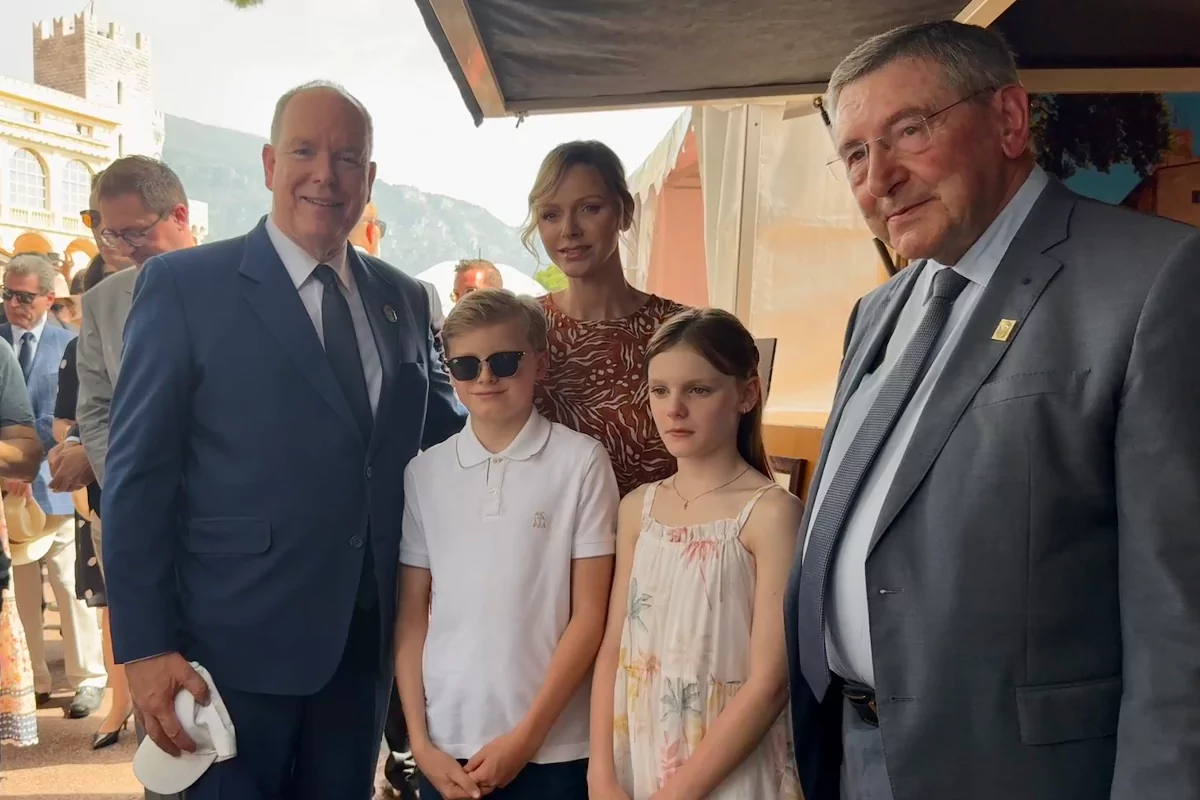

Main photo credit: Cassandra Tanti, Monaco Life